Active trading brings opportunity, but it also brings paperwork. For 2026 tax reporting, regulators across North America, Europe, and key Middle East markets continue tightening data matching and expanding digital-asset reporting. Translation: if it moved, swapped, earned, or expired, it likely needs to be tracked.

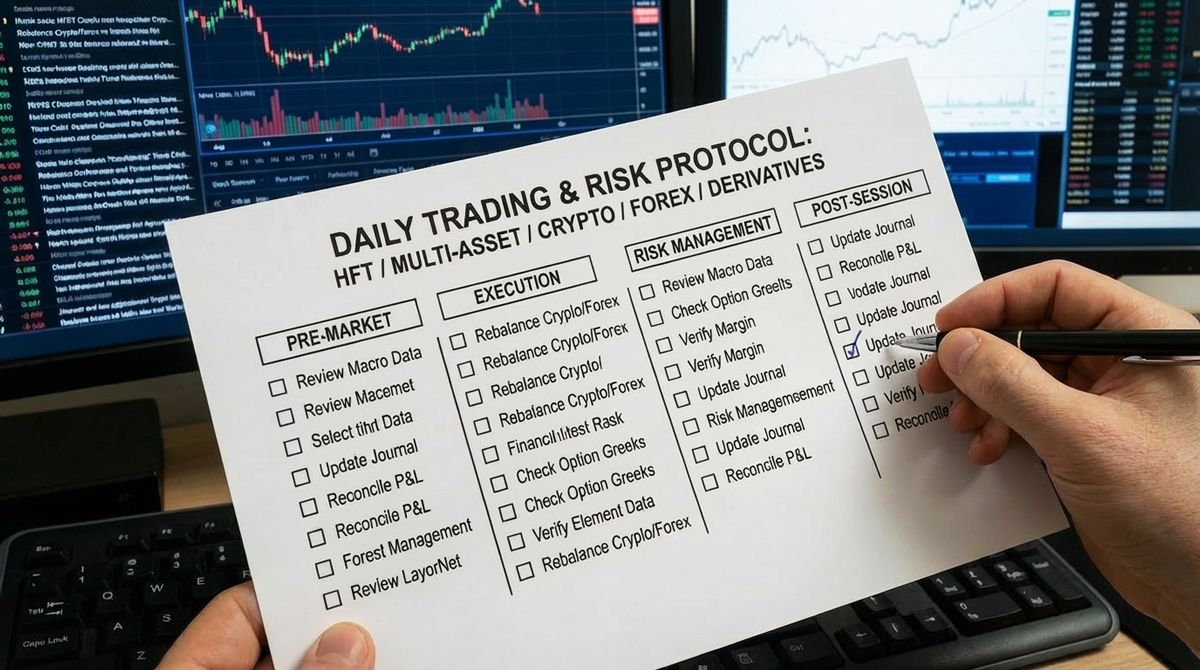

Below is a practical checklist designed for high-frequency traders, multi-asset investors, and anyone juggling crypto, forex, equities, and derivatives.

Every Trade Event (Not Just Profitable Ones)

Tax authorities calculate gains and losses per transaction, not per account balance.

Track, for each trade:

- Date and time (to establish holding period)

- Asset pair or contract

- Quantity

- Entry and exit price

- Fees and commissions

- Exchange or broker used

Why it matters:

- Losses are just as important as gains for net tax results.

- Day traders and derivatives traders often trigger hundreds or thousands of reportable events.

Cost Basis and Accounting Method

Your cost basis determines how much of each sale is taxable profit.

Key points to track:

- Original acquisition price (including fees)

- Which accounting method applies:

- FIFO (first in, first out)

- LIFO (last in, first out)

- Specific identification (where allowed and properly documented)

Regional notes:

- Many countries default to FIFO unless specific identification is clearly supported.

- Some EU jurisdictions require weighted averages for certain asset classes.

- Crypto platforms increasingly report cost basis directly to tax authorities, so your records should reconcile with platform statements.

Transfers Between Wallets and Accounts

Moving assets is usually not taxable, but it must be provable.

Track:

- Source and destination addresses or account IDs

- Date and amount transferred

- Network or transfer fees

Why this saves headaches:

- Without transfer records, inbound funds may look like new income.

- Exchanges and tax agencies increasingly cross-reference inflows.

Income vs Capital Gains (Big Difference)

Not all profits are treated the same.

Common taxable income categories:

- Staking rewards

- Yield or lending interest

- Airdrops

- Referral or affiliate bonuses

- Some copy-trading rebates

Common capital gains events:

- Selling assets for fiat

- Swapping one crypto for another

- Closing forex or CFD positions

- Exercising or settling options

Why classification matters:

- Income is often taxed at higher marginal rates.

- Capital gains may qualify for lower rates or exemptions depending on holding period and country.

Derivatives and Complex Instruments

For active traders, this is where reporting gets spicy (financially, not emotionally).

Track separately:

- Futures contracts (open, close, expiry)

- Options (premium paid, exercise, expiration)

- CFDs and spread betting where legal

Important:

- Some jurisdictions tax derivatives as ordinary income rather than capital gains.

- Mark-to-market rules may apply for professional or high-volume traders in certain countries.

Foreign Accounts and Platforms

Using overseas exchanges or brokers can trigger additional disclosures, even if profits are small.

Track:

- Maximum account balances during the year

- Country of the institution

- Account opening and closing dates

Why it matters:

- Many countries require foreign asset reporting even if no tax is owed.

- Penalties for missing disclosures can exceed the tax itself. That’s not a plot twist you want in April.

Withholding, VAT, and Transaction Taxes

Depending on location and product type, extra layers may apply.

Possible deductions or charges:

- Withholding taxes on dividends or interest

- Financial transaction taxes in certain markets

- VAT or service taxes on platform fees in parts of Europe

Track:

- Any tax already withheld by brokers or platforms

- Official statements showing deductions

These amounts may be creditable against your final tax bill if properly documented.

Business vs Personal Trading Status

For high-volume traders, classification can materially change the tax outcome.

Indicators tax agencies look at:

- Frequency and regularity of trades

- Use of leverage and derivatives

- Whether trading is a primary income source

- Formal business registration or structure

Why this matters:

- Business traders may deduct expenses like data feeds, software, hardware, and education.

- Business income may also face different tax rates and social contributions in some countries.

Documentation You’ll Want at Filing Time

Have these ready before tax season hits:

- Full transaction exports from every exchange and broker

- Wallet transaction histories

- Staking and rewards statements

- End-of-year account balance summaries

- Proof of transfers between personal accounts

Practical habit that saves real money:

Download reports quarterly, not just once a year. Platforms change, accounts close, and “export history” buttons have excellent timing for disappearing acts.

Tools vs Manual Tracking

Spreadsheets still work, but only if:

- Trades are logged consistently

- Balances are reconciled regularly

- Backups exist (future-you will be grateful)

Many active traders now use:

- Portfolio tracking software that integrates with exchanges

- Dedicated tax reporting platforms that calculate gains automatically

Even with software, always spot-check results. Automation is helpful, not magical.

MarketMind Insight – The traders who avoid penalties aren’t the ones with the fanciest spreadsheets or the most expensive accountants. They’re the ones with clean, complete, and timely records. For 2026 reporting, treat tracking like part of your trading strategy, not a chore you’ll “totally do later.” Your future tax return will thank you.